Minimizing Error And Omission Liabilities As A Business

In today’s litigious business environment, professional service providers face unprecedented exposure to errors and omissions (E&O) claims. These claims, which arise when clients suffer financial losses due to alleged professional mistakes or failures to act, can devastate businesses of all sizes. Understanding how to minimize E&O liabilities has become essential for protecting both your company’s financial stability and professional reputation.

Understanding the Scope of E&O Risks

Errors and omissions liabilities extend far beyond simple mistakes in professional judgment. They encompass a broad range of potential failures including missed deadlines, inadequate advice, failure to disclose material information, and breach of professional duties. The financial impact can be staggering, with the average E&O claim settlement reaching approximately $54,000 according to industry data, while more complex cases can result in settlements exceeding several million dollars.

Professional service industries face particularly high exposure rates. Legal professionals experience E&O claims at a rate of roughly 4-6% annually, while accounting firms see claim frequencies of approximately 2-4% per year. Technology consultants and financial advisors also face significant exposure, with claim frequencies continuing to rise as businesses increasingly rely on professional services for critical operations.

Implementing Comprehensive Documentation Practices

The foundation of E&O liability protection lies in meticulous documentation practices. Maintaining detailed records of all client communications, decisions, and deliverables creates a paper trail that can prove invaluable in defending against unfounded claims. This documentation should include meeting minutes, email correspondence, project timelines, and signed acknowledgments of work completed.

Establishing standardized processes across your organization ensures consistency in documentation quality. Every client interaction should be recorded with sufficient detail to reconstruct the circumstances months or years later. This systematic approach not only protects against claims but also improves overall service quality by creating accountability and clear expectations.

Digital documentation systems have revolutionized record-keeping capabilities, allowing businesses to maintain searchable, time-stamped records of all professional activities. Cloud-based systems provide additional security through automated backups and access controls, ensuring critical documentation remains available when needed most.

Strengthening Client Communication and Expectation Management

Clear communication serves as the primary defense against E&O claims stemming from misunderstood expectations or scope creep. Establishing written agreements that precisely define deliverables, timelines, and limitations helps prevent disputes before they arise. These agreements should explicitly outline what services will and will not be provided, creating clear boundaries for professional responsibility.

Regular client updates and progress reports maintain transparency throughout the engagement process. When clients remain informed about project status, potential challenges, and any changes in scope, they are less likely to feel surprised or misled if issues arise. This proactive communication approach has been shown to reduce claim frequency by up to 40% in some professional service sectors.

Managing client expectations also involves honest discussions about potential risks and limitations associated with your services. While this transparency might initially seem counterproductive, clients appreciate candor and are more likely to maintain realistic expectations when they understand the inherent uncertainties in professional work.

Professional Training and Competency Development

Maintaining current professional competencies represents a critical component of E&O risk management. Industries evolve rapidly, and professionals who fail to stay current with best practices, regulations, and technological developments face increased liability exposure. Implementing comprehensive continuing education programs ensures your team remains knowledgeable about the latest developments in their fields.

Regular training should cover both technical skills and risk management practices. Staff members should understand how their daily decisions and actions can impact liability exposure. This awareness creates a culture of risk consciousness that permeates all aspects of professional service delivery.

Specialization can also reduce E&O risks by ensuring professionals work within their areas of expertise. When businesses attempt to provide services outside their core competencies, they significantly increase their liability exposure. Maintaining clear boundaries around service offerings and referring clients to appropriate specialists when necessary demonstrates professional responsibility and reduces potential claims.

Quality Control and Review Systems

Implementing systematic quality control measures creates multiple opportunities to identify and correct potential errors before they impact clients. Peer review processes, where work is examined by colleagues before delivery, can catch mistakes that individual professionals might overlook. These systems are particularly effective in complex professional environments where small errors can have significant consequences.

Regular internal audits of completed work help identify patterns that might indicate systemic issues requiring attention. By analyzing past projects and client feedback, businesses can identify areas for improvement and implement corrective measures before problems result in claims.

Technology solutions increasingly support quality control efforts through automated checking systems and workflow management tools. These systems can flag potential issues, ensure required steps are completed, and maintain audit trails of all review activities.

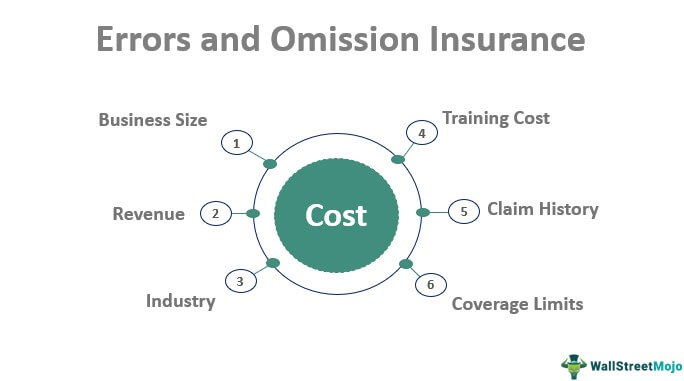

Insurance Considerations and Risk Transfer

While prevention remains the primary focus, comprehensive EO insurance coverage provides essential protection against unavoidable claims. Professional liability insurance, often integrated with contractor insurance packages for businesses providing on-site services, helps cover legal defense costs and settlement payments when claims arise despite best prevention efforts.

Understanding policy terms and coverage limitations ensures adequate protection levels. Many businesses discover coverage gaps only after claims arise, making proactive policy review essential. Working with experienced insurance professionals who understand your industry’s specific risks helps ensure appropriate coverage selection.

Building a Sustainable Risk Management Culture

Long-term E&O liability reduction requires embedding risk awareness into your organization’s culture. This involves creating systems where employees feel comfortable reporting potential issues without fear of punishment, enabling early intervention before problems escalate into claims.

Regular risk assessment activities help identify emerging threats and adapt prevention strategies accordingly. As business environments continue evolving, maintaining flexibility in risk management approaches ensures continued effectiveness in minimizing E&O liabilities while supporting business growth and client satisfaction.